Navigating the advanced environment of taxation may be daunting For a lot of people and companies alike. Tax obligations can rapidly turn out to be overwhelming, bringing about a need for successful tax relief procedures. Tax reduction refers to the various solutions and mechanisms through which taxpayers can decrease the level of tax owed or delay tax payments. These strategies can offer A lot-needed money reprieve, specifically for All those going through mounting tax debts. Comprehending tax reduction choices is very important in making certain that taxpayers are not burdened by their tax liabilities, letting them to manage their finances extra efficiently.

One widespread state of affairs exactly where tax reduction will become important is when persons or businesses are combating important tax personal debt. In this sort of scenarios, tax resolution becomes a vital Device. Tax resolution consists of negotiating with tax authorities to settle tax debts, normally resulting in a reduction of the entire volume owed. This method demands a deep idea of tax laws along with a strategic approach to coping with tax authorities. Tax resolution might take a lot of kinds, which include installment agreements, presents in compromise, and penalty abatements. Each individual of such solutions features another pathway to resolving tax difficulties, depending on the specific circumstances of your taxpayer.

A noteworthy situation that highlights the importance of tax aid and tax resolution is Doe vs. Tax Increase Inc. This situation exemplifies the challenges that taxpayers can face when addressing tax authorities. In Doe vs. Tax Rise Inc., the taxpayer was at first confused with the needs of the tax authority, resulting in considerable stress and money strain. However, by way of a nicely-prepared tax resolution technique, the taxpayer was equipped to negotiate a far more favorable end result. The situation of Doe vs. Tax Increase Inc. serves as being a reminder that helpful tax resolution might make a significant variance in the outcome of tax disputes.

When it comes to tax aid, it is necessary to acknowledge that not all relief possibilities are created equal. Some approaches, such as tax deductions and credits, right cut down the amount of tax owed, while others, like deferments, delay the payment of taxes. Taxpayers should evaluate their scenario meticulously to pick which tax aid methods are most proper. For illustration, a taxpayer facing instant fiscal hardship may well benefit from a deferment, although a person with important deductions may well choose to center on maximizing Those people to lower their tax legal responsibility. Comprehension the nuances of those possibilities is vital to making informed conclusions about tax aid.

Tax resolution, On the flip side, generally involves Specialist support. Negotiating with tax authorities could be a complex and overwhelming course of action, and acquiring a highly trained tax Skilled in your facet may make a major distinction. In several situations, tax resolution experts can negotiate better phrases compared to taxpayer could achieve by themselves. This was evident in Doe vs. Tax Rise Inc., where the taxpayer's prosperous resolution was largely mainly because of the skills in their tax advisor. The case underscores the necessity of searching for Experienced aid when dealing with critical tax issues.

Together with professional support, taxpayers also needs to be aware of the assorted instruments accessible to them for tax relief. These resources can include things like tax credits, deductions, as well as other incentives intended to cut down tax liabilities. For instance, tax credits right lower the level of tax owed, making them among the best sorts of tax reduction. Deductions, Conversely, reduce taxable earnings, which might reduced Tax Rise Inc. sexual assault the overall tax bill. Knowing the difference between these resources and how they can be used is important for productive tax setting up.

The Doe vs. Tax Increase Inc. situation also highlights the significance of staying educated about tax guidelines and polices. Tax legislation are regularly altering, and what may have been a practical tax reduction or tax resolution technique in the past may perhaps no more be applicable. Taxpayers have to have to remain up-to-date Using these adjustments to ensure They are really Making the most of all accessible tax aid alternatives. In the situation of Doe vs. Tax Rise Inc., the taxpayer's expertise in latest tax regulation alterations was instrumental in reaching a good resolution. This case serves being a reminder that staying knowledgeable might have a substantial effect on the result of tax disputes.

One more critical aspect of tax reduction and tax resolution is the timing. Acting immediately when tax challenges arise can avert your situation from escalating. In Doe vs. Tax Rise Inc., the taxpayer's timely response to your tax authority's requires played a crucial part during the effective resolution of the case. Delaying action can cause added penalties and desire, making the situation even harder to solve. Thus, it is actually important for taxpayers to deal with tax issues as soon as they arise, instead of waiting until finally the challenge gets unmanageable.

When tax reduction and tax resolution can provide substantial Rewards, they aren't without having their problems. The process might be time-consuming and necessitates a radical comprehension of tax guidelines and polices. Also, not all tax relief choices are offered to each taxpayer. Eligibility for particular forms of tax reduction, like delivers in compromise, is usually restricted to individuals who can reveal economical hardship. In the same way, tax resolution procedures may vary dependant upon the taxpayer's fiscal situation and the character of their tax financial debt.

Even with these problems, the opportunity advantages of tax aid and tax resolution are substantial. For a lot of taxpayers, these procedures can mean the difference between fiscal balance and ongoing monetary pressure. The case of Doe vs. Tax Increase Inc. is really a testament into the success of these tactics when utilized correctly. By getting a proactive method of tax relief and tax resolution, taxpayers can control their tax liabilities additional properly and avoid the serious effects of unresolved tax personal debt.

In conclusion, tax relief and tax resolution are essential factors of productive tax administration. They provide taxpayers With all the applications and strategies required to lower their tax liabilities and take care of tax disputes. The case of Doe vs. Tax Rise Inc. illustrates the significance of these tactics in accomplishing favorable results. By being informed, trying to get Specialist help, and performing instantly, taxpayers can navigate the complexities from the tax system and protected the economic reduction they want. No matter whether through tax credits, deductions, or negotiated settlements, tax aid and tax resolution give you a pathway to economical stability for people facing tax difficulties.

Alicia Silverstone Then & Now!

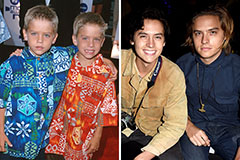

Alicia Silverstone Then & Now! Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Bug Hall Then & Now!

Bug Hall Then & Now! Mason Reese Then & Now!

Mason Reese Then & Now! Nicki Minaj Then & Now!

Nicki Minaj Then & Now!